how much does cat health insurance cost in practice: field notes and expectations

Quick ranges at a glance

I price policies weekly for clients and my own crew. Typical U.S. premiums land here, assuming a healthy cat:

- Accident + illness: $20 - $55/month for young indoor cats; $45 - $90+ for seniors.

- Accident-only: $10 - $25/month.

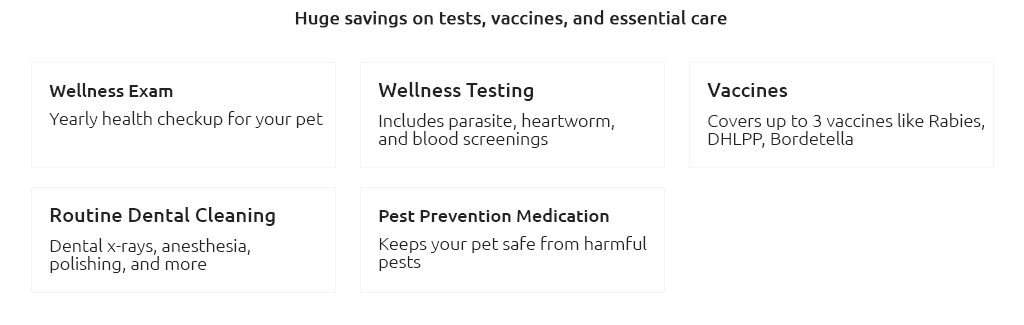

- Wellness add-on: usually $10 - $30/month if you want routine care reimbursed.

Premiums are just one piece. You still handle the deductible, your copay, and anything the policy excludes.

What actually drives price

- Age: each birthday nudges premiums up; first sign-ups are cheapest.

- Zip code: urban ER fees push rates higher than small-town clinics.

- Breed risk: purebreds with known issues can run pricier.

- Plan levers you control: lower deductible + higher reimbursement + higher annual limit = higher premium.

- Add-ons: dental illness, rehab, wellness can add a steady $5 - $30/month.

- Claims history: future renewals may rise faster if usage is heavy.

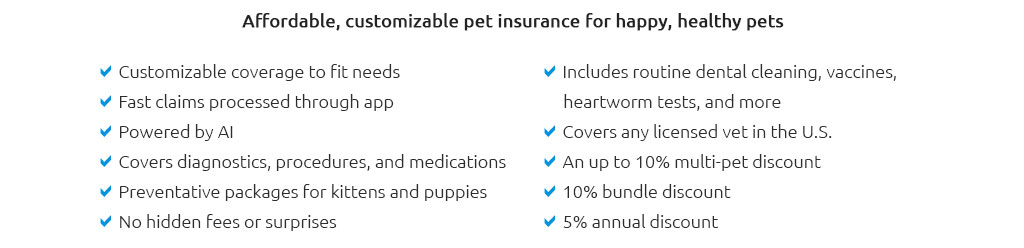

- Discounts: multi-pet, pay-annual, military - small but helpful.

Field notes from the exam room

Tuesday afternoon, Pepper's pre-dental bloodwork flagged tartar and mild gingivitis. Cleaning with dental X-rays at our clinic priced at $1,050. Her plan: $29/month, $250 deductible, 80% reimbursement, $5,000 limit. After the visit, we filed on the app in the parking lot while Pepper snored in her carrier. The claim paid $640 (exam fee excluded, deductible applied). Out of pocket was roughly $410 for that event plus the monthly premium you already budget. That's the cadence: a predictable subscription buying you help on the spikes.

How to estimate your monthly number in 5 minutes

- Note your cat's age, breed, and zip.

- Grab two quotes with the same levers: $250 - $500 deductible, 80% reimbursement, $5k - $10k annual limit.

- Record the premium and the per-claim math (what you'd pay on a $1,000 vet bill).

- Add optional wellness only if you already spend that much yearly on exams, vaccines, and tests.

- Sanity-check with your clinic's typical ER and chronic-care costs; adjust levers to stay inside your monthly comfort zone.

Expectations you can set now

- Waiting periods: accidents often 2 - 5 days; illness 14 - 30; orthopedic can be longer.

- Annual increases: budget for a yearly step-up as your cat ages.

- Exam fees: sometimes excluded unless you pick a plan that includes them.

- Dental: illness/injury usually covered; routine cleanings only with wellness or a dental rider.

- Pre-existing conditions: not covered; get in before problems start.

- Claim timing: typical 2 - 10 business days once records are in; emergencies feel faster when you've pre-uploaded medical history.

Cost math in one minute

Example: a $1,200 emergency. With a $500 deductible and 80% reimbursement, eligible amount after deductible is $700; insurer pays $560. You pay $640 (your $500 deductible + 20% of the remainder), assuming you haven't met the deductible yet and you're under the annual limit.

Budget guardrails

- $15 - $30/mo: entry coverage (accident-only or higher deductible). Protects the "fall-from-the-shelf at 2 a.m." bills.

- $30 - $55/mo: balanced accident + illness, common for young adults.

- $55 - $90+/mo: older cats, robust limits, lower deductibles, or richer extras.

Choose support you'll actually keep paying through quiet months; insurance works best when you let it ride, not when you chase the perfect slider combo.

Choosing support, not perfection

I coach families to buy enough coverage to blunt the big surprises and keep care choices open, then stop tweaking. If the premium fits your routine budget and the claim math makes one ER visit survivable, you're set - and you can adjust as your cat's needs reveal themselves over the seasons...